How It Works

Credit Checks on Tenants in 3 Steps

With LeaseRunner

What's Included?

What's Included in

LeaseRunner's Credit Records?

Most comprehensive nationwide consumer credit information available on more than 300,000,000 rental applicants.

Applicant's name and current address

Previous addresses

Employer's name, address, time frame

Previous employer's name, address, time frame

Alternate names

VantageScore 3.0

Bankruptcy, foreclosure, repossession

Payment amount and status

Open, balance, and last payment dates

Original amount and current balance

Creditor's name

Type and terms of the credit accounts

Account condition

Payment history (current or past due)

Account limit and highest balance

Open, balance, and last payment dates

Collections, charge-offs

Reporting court's name and number

Book and page number of record

Filing date, status change date

Amount and type of public record

Plaintiff's name

Compliance condition code

Benefits

Screen Beyond the Credit Score

Get full account details, payment trends, and income-to-rent ratios— sourced from Experian and the applicant, delivered instantly.

Get Accurate Credit Check Results

Access the most comprehensive consumer credit information with data on over 300 million rental applicants nationwide, provided directly by Experian.

Never Miss Out on Credit Insights

Go beyond the score and gain a clearer view of the tenant's financial stability with detailed account info, payment history, and Income-to-Rent ratio.

Simple & Secure Digital Report Processing

Tenants authorize the release of their credit reports electronically, with automatic identity verification to ensure secure and hassle-free processing.

Pricing Plans

Pay-as-you-go and decide who covers the fees, with complete transparency in pricing.

Basic Screening

$17/per applicant

*Paid by applicant or landlord.

Pro Screening

$40/per applicant

*Paid by applicant or landlord.

Ultimate Screening

$54/per applicant

*Paid by applicant or landlord.

Most popular

Premium Screening

$64/per applicant

*Paid by applicant or landlord.

Criminal Background Records

Custom URL and Applications

State-Compliant Data

Address History

Identity Verification

Full Credit Report

VantageScore 3.0

Eviction Records

Nationwide Eviction Database

Judgment Amount Details

Income Verification & Cash Flow Report

Payroll Deposits

Income & Expense Summary

Bank Account Balance

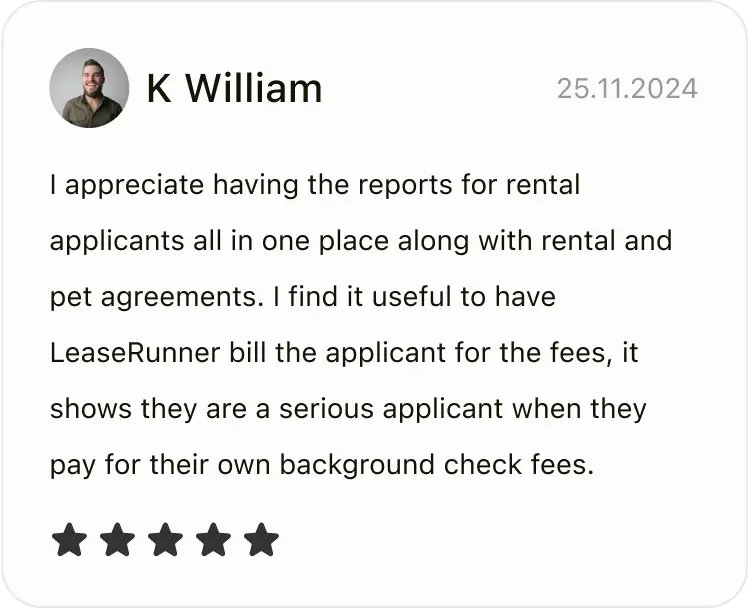

Testimonials

Over 12 Years of Trust and Success

A few words from our client

Credit Reports That

Do More Than Just Score

Get comprehensive credit data at your fingertips. Sign up now to make informed leasing decisions, risk-free.

Discover More Features

FAQs

Frequently Asked Questions

Landlords review tenants' credit scores, payment history, outstanding debts, and any recent bankruptcies. These details help landlords assess whether a tenant can reliably pay rent and manage their finances.

To run a credit check on tenants through LeaseRunner, simply:

- Create an account.

- Enter the tenant's information.

- Request their consent.

Once approved, we provide you with a comprehensive credit report, which includes their credit score, history, and any potential red flags.

When landlords run a credit check for apartment rentals, they’re looking for signs of financial responsibility to ensure you can reliably pay rent. Here’s what they typically focus on:

- Payment History: A track record of paying bills on time, including credit cards, loans, or previous rent, shows the applicant is dependable.

- VantageScore: A good score from 650 gives landlords a snapshot of your creditworthiness. The higher the Vantagescore, the easier it is to qualify for an apartment.

- Debt-to-Income Ratio: Landlords check how much of the applicant’s income goes toward debt payments to confirm he or she can afford rent alongside other obligations.

- Public Records: Issues like bankruptcies and legal judgments may raise concerns for landlords.

- Length of Credit History: A longer credit history helps landlords see how well you’ve managed your finances over time.

With LeaseRunner, the cost of credit checks, priced at $23 per applicant, can be paid by either the landlord or the tenant. Landlords have the flexibility to choose who covers the fee based on their preferences or local regulations. This ensures a smooth tenant screening process while providing clarity on payment responsibilities.

LeaseRunner uses Experian as the credit bureau for tenant screening, providing detailed credit reports. These reports include the VantageScore 3.0 credit score, along with information on addresses, employment (if available), and any liens, bankruptcies, or judgments.